First founded in 1971, the World Economic Forum (WEF) is a platform where global leaders and experts gather to discuss global issues. Also known as the Davos Forum, named after the town in Switzerland where it is held, the forum seeks to improve the world by engaging leaders of society from politics, business, and academia, to shape global, regional, and industry agendas.

This year, LG Chem CEO Shin Hak Cheol was formally selected as a member of the WEF’s International Business Council (IBC*), after receiving official invitations from both the Board of Directors and the Executive Committee. At this year’s forum, held from January 15th to 19th, CEO Shin met with global clients and partners to discuss collaboration strategies for managing the global supply chain, and potential solutions for overcoming the climate crisis. In addition, as a global leader in the chemical industry, he authored an article that reflects on the changes in the industry and its future. Today, we present his insights into 2023 and the outlook for 2024.

*IBC (International Business Council): A consultative body composed of approximately 100 representatives from various sectors of the economy. It is recognized as an advisory body driving the World Economic Forum and a gathering of the most influential leaders in the economic sphere.

Looking back on 2023

Recently, the IMF announced the global economic growth rate to be 3% for 2023. The global economic downturn continues, even though many countries declared an end to COVID-19 in the first half of 2023. The post-pandemic global economy is still falling short of pre-pandemic levels.

And this is just a sliver of a complex and rapidly changing external environment, which we have not seen in the past decades. Inflation, geopolitical conflict, and a deepening climate crisis are constantly looming as threats to the world. All this made 2023 a difficult year for companies in the sector.

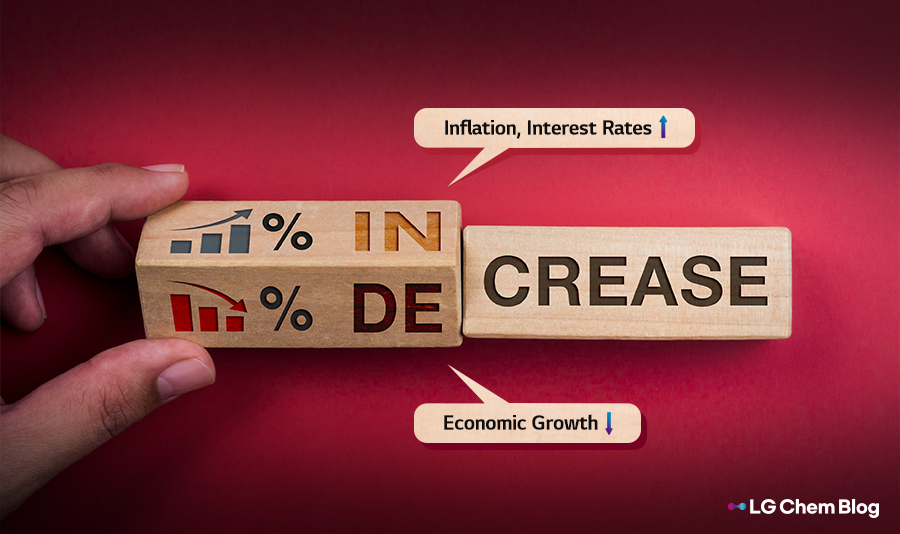

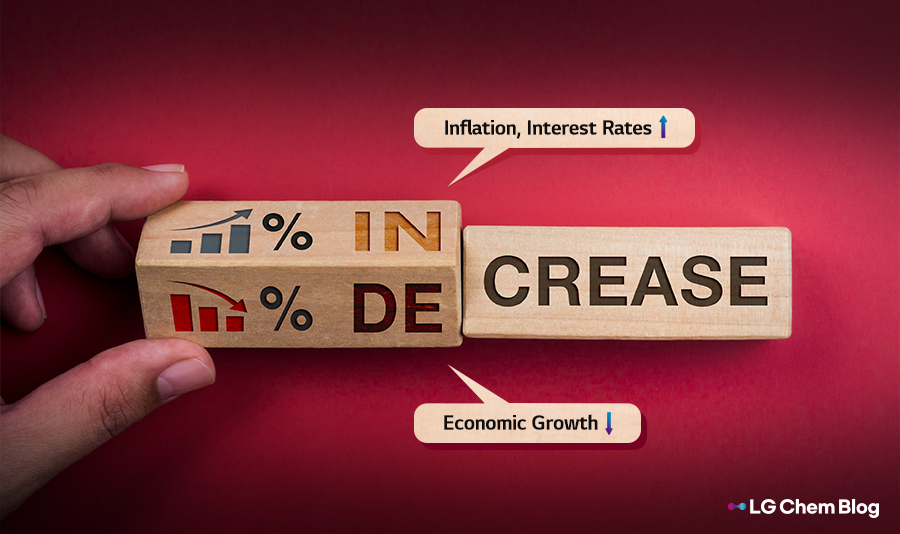

Trouble trio: Low growth, high inflation, high interest rates

The global economy was predicted to recover in the first half of 2023 since the pandemic was finally over and China’s post-pandemic reopening was expected to boost consumption growth. We see now that China’s reopening didn’t have a significant effect on the world economy, and that the global economic downturn seems to continue, with a worsening real estate crisis and manufacturing slump. Even though interest rate hikes continue in the US, inflation has not been resolved. It seems likely that the triple whammy of low growth, high inflation, and high interest rates will be ongoing.

In this context, chemical companies are finding it difficult to recover their operation rates due to sluggish consumer demand and have difficulty finding operation cash due to high interest rates. The response? Pre-emptive downsizing of assets that are less competitive and have uncertain future growth potentials. We saw a few of these moves in 2023.

Turning global supply chains into localized operations

We witnessed geopolitical conflicts intensifying around the world and saw prices of many raw materials soaring due to regional geopolitical and geoeconomic disputes – from oil and natural gas, through agricultural products, to key minerals. This is in parallel to an accelerated restructuring of global supply chains which has been illustrated as a resilience-building move.

Incentive programs and/or regulations announced in the US and Europe such as Inflation Reduction Act (IRA), Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS), and the Critical Raw Materials Act (CRMA) have been rolled out to foster domestic industries. In response, China has implemented export controls on key minerals such as gallium and germanium and is actively pursuing local investment to boost internal demand and build a self-reliant supply chain. Of particular interest is the aggressive expansion in the petrochemical industry pursued by China to increase its self-sufficiency rate in base oil which, for example, is expected to exceed 100% in basic oil within the next 2-3 years.

In response to measures understood as protectionist and the fencing of economic blocs, companies re-examined their strategic directions, especially global supply chain strategies. Their continuous review of risk hedging strategies through establishing various partnerships or localization has seen a boost through 2023.

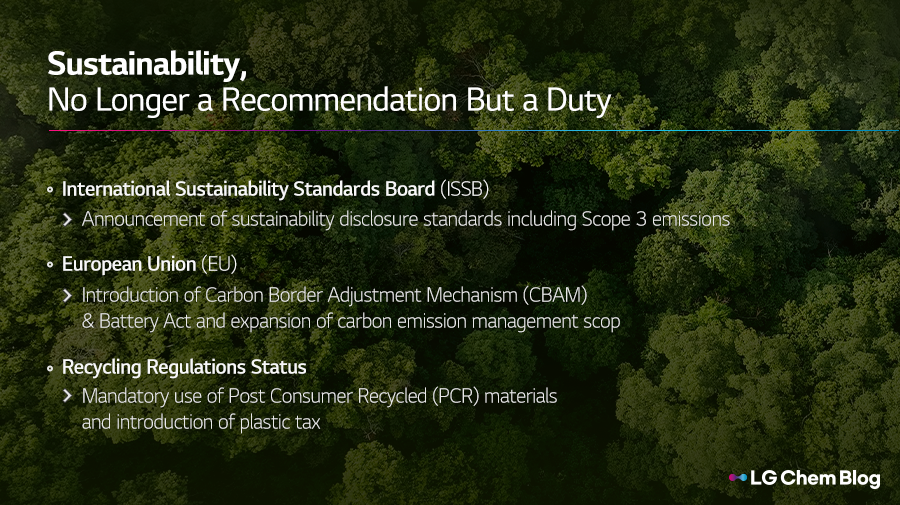

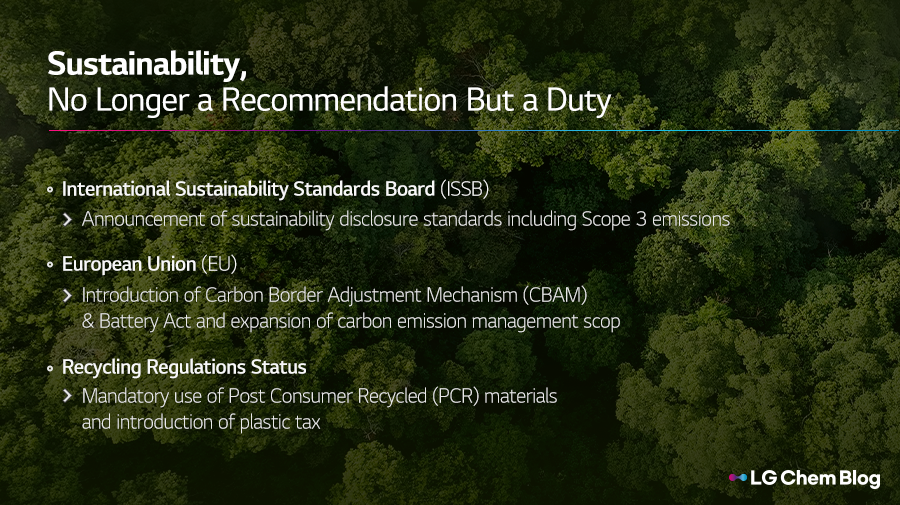

ESG and sustainability under threat

Through 2023 there were signals of Environmental, Social, and Governance (ESG) and the broader sustainability agenda partially losing momentum due to the global economic turndown. For example, last summer Italy, Portugal, Slovakia, Bulgaria and Romania called for postponing the retirement period for internal combustion engine vehicles from 2035 to 2040, while regulations on carbon emissions kept advancing towards their standardization in major economies such as the EU and the US. Consumers were increasingly vocal about the environmental sustainability performance of products and practices in their daily lives.

Nevertheless, 2023 brought the industry to a new level in regulation for sustainability with (for example) the announcement of ISSB* sustainability disclosure standards and its inclusion of Scope 3 emissions. This entails companies disclosing not only direct or indirect emissions (Scope 1 and 2), but also Scope 3 emissions (all carbon emissions excluding indirect emission sources corresponding to Scope 2). It marks the first time that major global standard-setting bodies have demanded Scope 3 emission reporting, setting a precedent for other institutions or regulatory programs to follow suit. The CBAM**/EU Battery Act also brought an expanded scope of carbon emissions management by subdividing carbon emissions regulations down to the product level. Regulations on recycling have expanded to include the mandatory use of Post Consumer Recycled (PCR) and the introduction of a plastic tax.

In the new(ish) context defined by 2023, companies declare carbon neutrality goals and find themselves more self-reliant in achieving them. Their responses are now pointing at re-establishing business portfolio strategies to align with demands for increased ESG and sustainability. What is different? The need to balance them with “growth”. This balancing act has become a delicate management challenge and will continue to be so for the foreseeable future.

*ISSB: International Sustainability Standards Board

**CBAM: Carbon Border Adjustment Mechanism

Accelerating electric vehicle expansion

The expansion of electric vehicles (EVs) has become an unstoppable trend. Major regions and countries, including the EU, the US, and China are announcing bills banning the internal sales of combustion engine vehicles. These are illustrations of how market dynamics, policy action, and megatrends couple to fuel innovation and investment.

According to a report by the International Energy Agency (IEA) released earlier this year, EV sales in 2023 are expected to be about 14 million, an increase of 4 million compared to the previous year. This is about 18% of the total vehicle sales. The EV market is expected to grow even more rapidly as technology develops since the market will reach the volume segment in the coming years. The proportion of EVs is expected to expand to 50-55% by 2030. In this way, the transition to eco-friendly energy will be gradually accelerating, while the demand for mobility oil will be decreased, making the peak oil* visible. Although the growth rate has moderated in 2023 due to consumers’ appetite for more affordable volume-segment EV options and high-interest rates, this seems to be a temporary moderation in growth rate and the overall trend will not fundamentally change.

*Peak Oil: The point at which oil production reaches its maximum level. After reaching the peak of oil production, there is a rapid decline.

A defining moment

One change process with great impact on the industry has gained traction in 2023, partly in response to the above fundamental changes in the business environment: oil majors and oil refineries expanding their businesses into their adjacent downstream area (petrochemicals). Competition within the chemical industry is intensifying especially in basic building blocks pushing further traditional chemical companies into seeking high growth/high added value to secure a competitive edge.

Each of these external environmental changes is serious enough to have a significant impact on business, and they are occurring simultaneously. With the current economic situation worsening the business environment for companies, even the most competitive companies may face a serious crisis if they do not accept changes and boldly approach them in new ways.

In the end, companies have two options for survival: to overcome or to accept the current crisis. This is a difficult situation for everyone, but also an excellent opportunity to improve corporate value and grow further, for those who continuously implement differentiated strategies for the future.

Today, we delved into the shifts and prospects of the chemical industry as envisioned by LG Chem CEO Shin Hak Cheol. 2023 posed various challenges for the chemical industry. However, amidst economic uncertainties, climate change, and sustainability regulations, new opportunities emerged. Even in these challenging times, LG Chem remains committed to preparing for the future with flexible strategies and differentiated approaches, striving for sustainable growth.

There are no comments yet! Be the first to let us know your thoughts!