In May 2023, LG Chem CEO Shin Hak-Cheol gave a keynote speech at the Bank of America (BofA) 2023 Korea & Global EV/EV battery conference, revealing the company’s aim to grow their battery materials sales sixfold by 2030 from that of 2022. LG Chem is targeting at the world’s top global comprehensive battery materials company through active R&D of essential battery materials such as cathode, separators, and additional materials, especially CNT. Check out the blueprint of LG Chem’s battery materials business and plans to accelerate their occupation of the CNT market.

Sales Target of $23.1 billion by 2030 in Battery Materials Business Alone

LG Chem announced their ambition to step up as the top global comprehensive battery materials company with sales of $23.1 billion (KRW 30 trillion) by 2030. To this end, the company will not only focus on cathode materials that have already attracted the global market, but also explore additional material businesses such as separators and carbon nanotubes (CNT). In addition, LG Chem will push forward R&D of new materials such as pure silicon anode and electrolytes for solid-state batteries. Learn more about how LG Chem plans to promote their battery materials.

Secure global leadership in the market·technology·metal sourcing of cathode materials

LG Chem’s cathode materials are already recognized in the global market for their product quality. In particular, the high-nickel cathode material with a higher proportion of nickel aims to pioneer the global leadership in three areas: market, technology, and metal sourcing. What are the strategies for each sector?

To start with, LG Chem intends to strengthen their leadership in the global cathode material market by establishing a global quadrilateral production system for cathode materials that connects Korea-China-U.S.-Europe, and increase their high-nickel production capacity from 120,000 tons in 2023 to 470,000 tons in 2028.

LG Chem will also tighten the technology leadership by expanding their high-nickel cathode product lineup for pouch-type and cylindrical batteries, mass-producing ultra-high-nickel cathodes with nickel content of 95%, and extending the application of single crystal cathode materials technology in the sector. In order to target the needs of rapidly-growing global EV market and customers, LG Chem is also considering expanding their offerings with cost-efficient cathode materials including high-voltage mid-nickel (Mid-Ni), lithium iron phosphate (LFP) and manganese-rich (Mn-Rich) to meet customer needs and target the growing mass market for electric vehicles (EVs).

Furthermore, LG Chem is cementing the global partnerships to secure their metal supply chain. In China, U.S., Australia, and Korea, the company is carrying out various initiatives such as establishing joint ventures (JVs) for precursors, signing lithium contracts, and making equity investments with major players including Huayou Cobalt, Piedmont Lithium, and KEMCO.

Expand additional battery materials business for further growth

Producing a battery requires additional materials such as separators, anode binders, and conductive additives. Among them, LG Chem is paying attention to the separator, a key material to secure battery stability, and owns a SRS® (Safety Reinforced Separator) technology which improves safety through ceramic coating. The collaboration of LG Chem’s world-class coating technology and Toray’s differentiated fabric technology is expected to add momentum to expanding the company’s presence in the Korean, European, and American separator market.

In addition, LG Chem is actively exploring growth opportunities based on innovative materials technologies such as pure-silicone (Pure-Si) anode materials, electrolytes for solid-state batteries, and flame-resistant battery materials like aerogels.

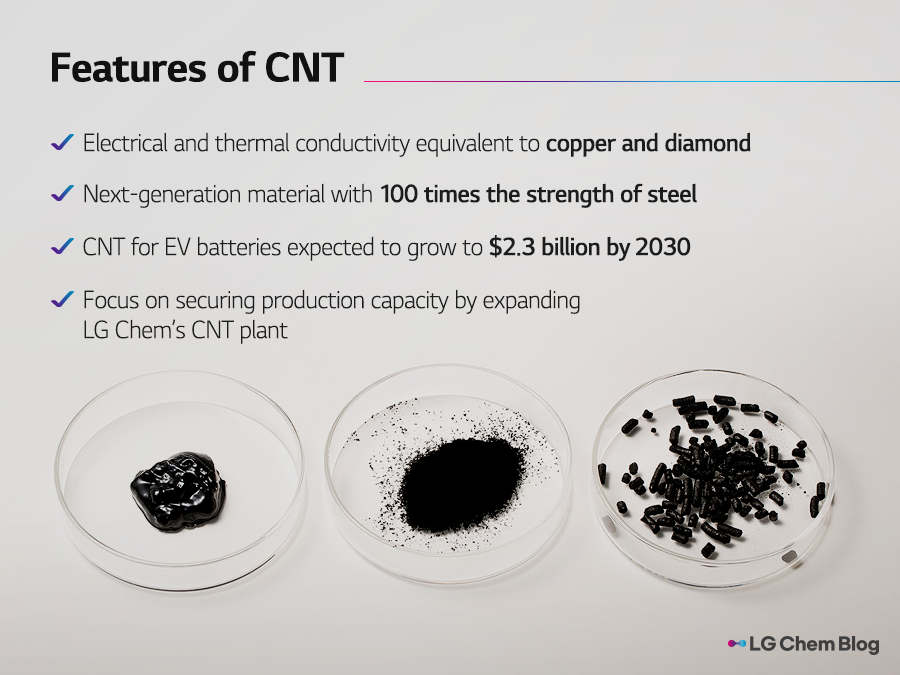

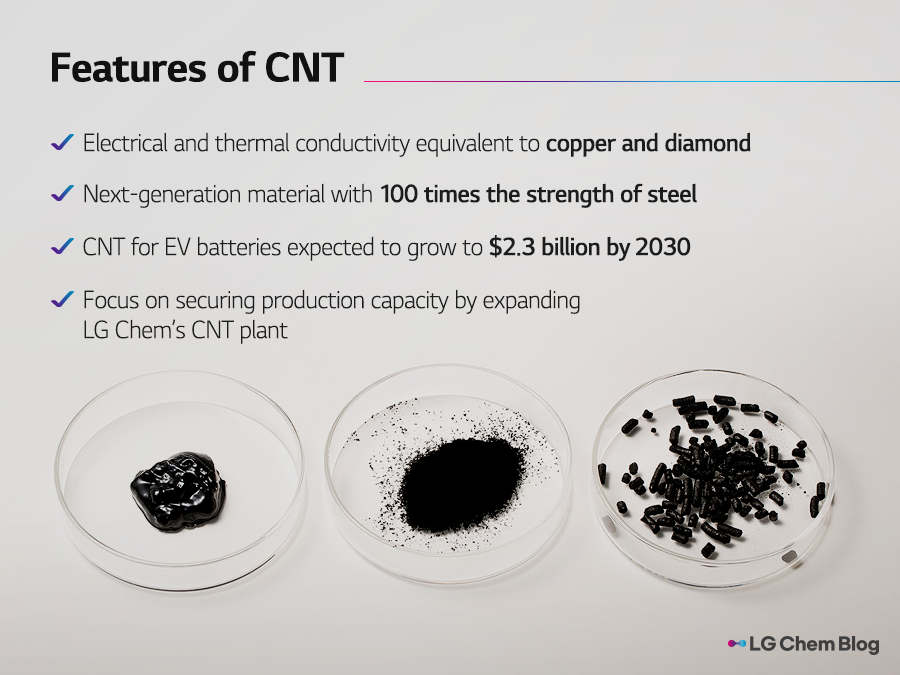

Accelerate occupation of global CNT market through high-quality CNT

CNT is a next-generation material with electrical and thermal conductivity equivalent to those of copper and diamond, and is 100 times stronger than steel. It is applied to EV batteries, semiconductor process trays, automotive electrostatic coating materials, etc. Thanks to its excellent electrical conductivity, CNT-based semiconductor process trays can withstand high temperatures and effectively block dust, electromagnetic waves, and static electricity. Also receiving high expectations in the market is CNT for EV batteries. It is expected that CNT for EV batteries will grow into a market worth about $2.3 billion (KRW 3 trillion) by 2030.

As new areas to which CNT can be applied are excavated, prospects are that global CNT demand will grow sharply at an average annual rate of about 30%, from 14,000 tons in 2022 to 95,000 tons in 2030. LG Chem seeks to preoccupy a firm competitive edge in the growing global CNT market by setting up more plants in Korea and securing high production capacity.

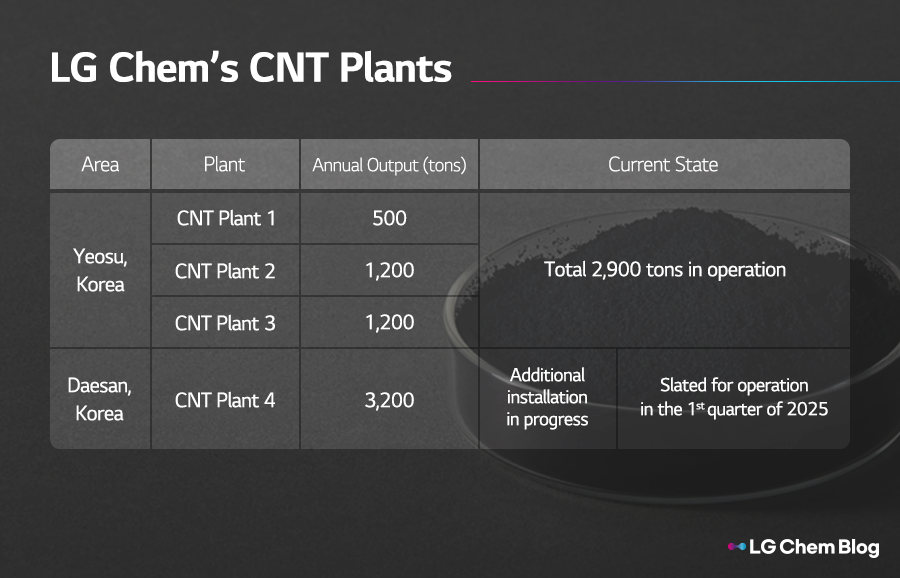

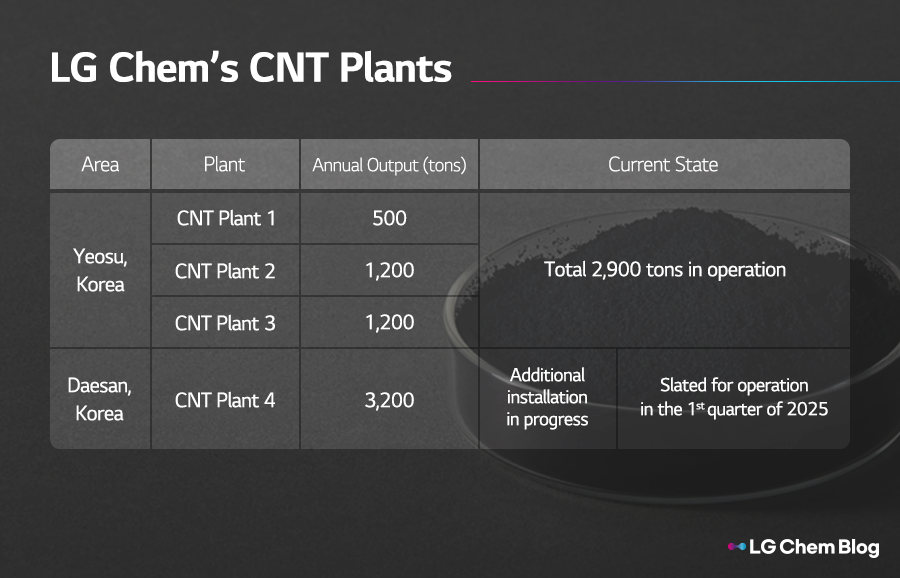

Starting with the first CNT plant with a capacity of 500 tons in 2017 and into the 2020s, LG Chem is installing additional plants every year to keep pace with the market expansion. As of June 2023, the annual CNT production capacity from CNT plant 1·2·3 reached 2,900 tons, and with the completion of CNT plant 4 in Daesan, Korea, it is expected to increase twofold to a total of 6,100 tons.

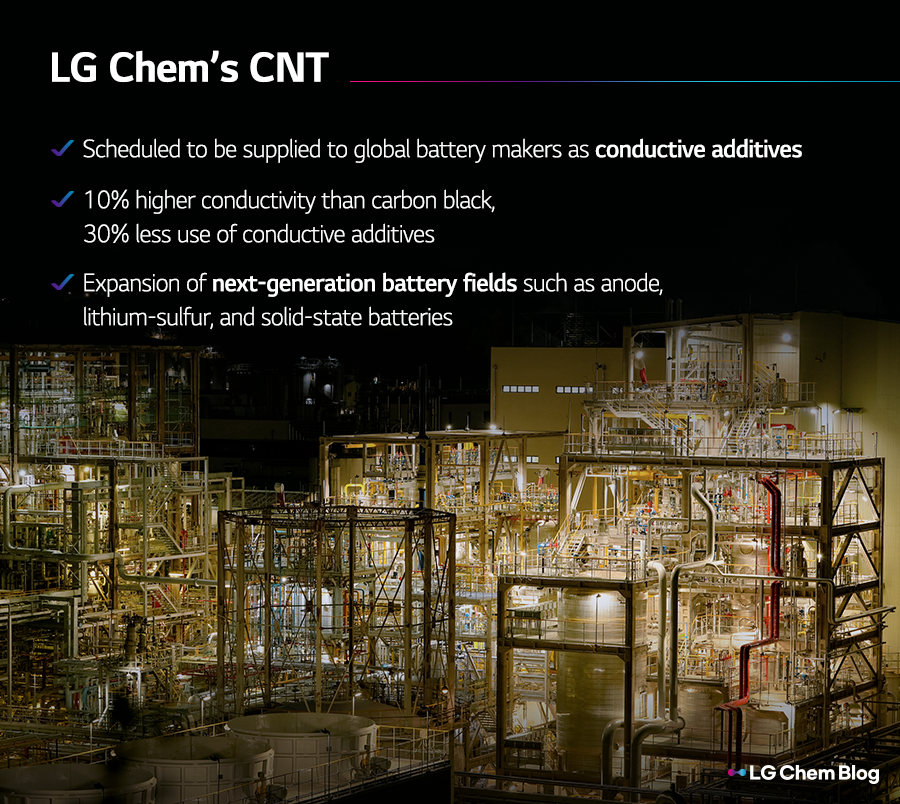

LG Chem’s CNT supplied to the global EV battery market

LG Chem owns a proprietary technology of self-developed fluidized bed reactor, which dramatically increases CNT productivity by rotating CNT powder inside the reactor. LG Chem’s CNT plants can produce up to 600 tons on a yearly basis, demonstrating the highest single-line capacity in the world.

Meanwhile, so far CNT production mostly depended on iron (Fe) catalysts with a relatively high metal and magnetic impurity content compared to cobalt, which made separate post-processing inevitable before commercialization. LG Chem developed a proprietary cobalt (Co) based catalyst technology, lowering the content of magnetic impurities that can affect battery quality, and succeeded in achieving world-class battery quality.

CNT materials produced by LG Chem will be supplied as conductive additives to global battery makers, with plans for usage to be expanded to a broader range of industries. Conductive additives help the flow of electricity and electrons in a battery, raising the conductivity of lithium-ions and thereby increasing the charge/discharge efficiency. When used as conductive additives for cathodes, CNT can reduce the volume of conductive additives in batteries by nearly 30% while achieving 10% more conductivity than carbon black. CNT-based batteries can deliver higher capacity and longer lifespan as more power-generating cathode materials can be used in place of the conductive additives. Thus, besides conductive additives for cathodes, CNT is also an attractive conductive additive of next-generation anode, lithium-sulfur, and solid-state batteries.

CNT expected to have myriads of applications

What is LG Chem doing to excavate new applications of CNT? In January 2023, LG Chem launched a task force (TF) to develop new CNT applications in addition to EV batteries. Recently, the company started supplying CNT-added, metal-replacing electrostatic coating* plastics to Japanese automaker Mitsubishi Motors, which is now applying the material to the front fenders of their three vehicle models. Furthermore, this plastic can be varied and customized to make other types of automotive parts such as bumper panels, hoods, tailgates, fuel doors, and side mirrors.

* Electrostatic coating: A method of applying electricity to paint and parts to color them with the sticking property of static electricity. Thanks to the excellent conductivity of CNT, it is eco-friendly because the amount of paint used is small, and it can be colored with a uniform thickness without restrictions on size or shape.

In addition, CNT can also be used as an electromagnetic shielding material to protect automotive radar sensors and modules. CNT is a shielding supplement that can replace metal and is applied to side mirrors and bumpers of cars to absorb signals and electromagnetic waves that cause irregular interference in autonomous driving functions such as Lane Keeping Assist System (LKAS) and Blind Spot Detection (BSD), contributing to the safety of a vehicle. LG Chem is currently supplying CNT to domestic automakers, allowing them to apply the material to their radar-absorbing system for electro-magnetic interference (EMI) purposes. The market is expected to continue to grow even more as demand for self-driving cars and electric vehicles continues to increase worldwide.

LG Chem is leading the battery material market through various means, such as establishing market·technology·metal sourcing strategies to target the cathode material market, expanding the value-added battery material businesses, targeting the global CNT market through CNT plant expansion, and developing new CNT applications. To become the top global battery materials company, LG Chem will continue their R&D efforts of diverse battery materials, including major battery materials, additional materials, and CNT.

There are no comments yet! Be the first to let us know your thoughts!