A chance to look into a corporate’s goals and visions, Investor Day! If you are an investor or have curiosity about the future of a company, you should pay close attention to this event. In February 8, 2022, LG Chem held Investor Day to announce their goals, vision, and detailed plans to the public. What was the blueprint presented by LG Chem?

Generate $46.2 billion in Sales, Centered on New Businesses

A gist of 2022 LG Chem Investor Day was the company’s sales goal. Back in 2021, LG Chem generated $20 billion (KRW 26 trillion) of sales, which, according to CEO Shin Hak-Cheol, will increase by over 130% to hit $46.2 billion (KRW 60 trillion) in 2030. How could such growth be possible? The basis of this is the expansion of LG Chem’s new businesses, and among them, LG Chem plans to focus on eco-friendly materials, battery materials, and global new drugs. Let’s take a look at the specific goals of each business sector.

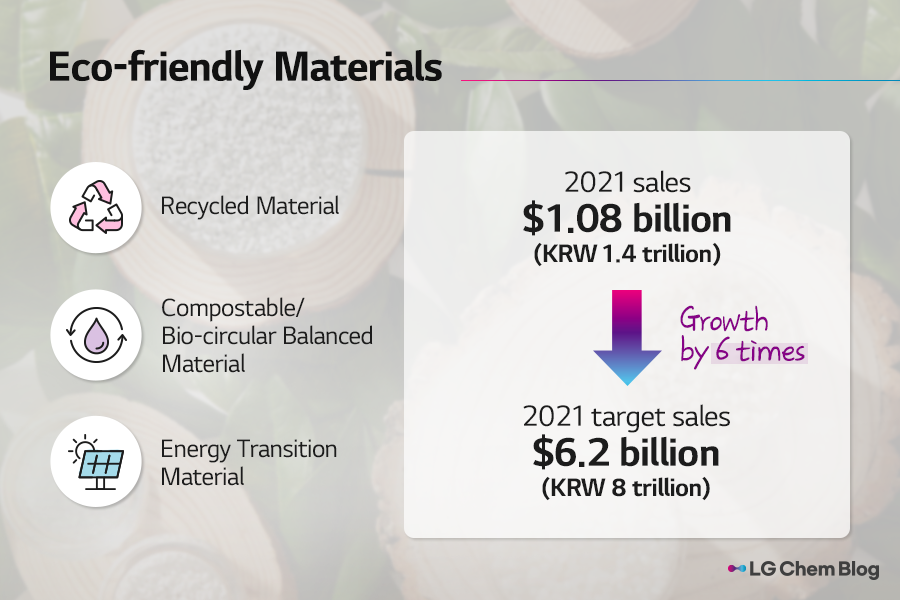

Eco-friendly Material – Recycled Material, Compostable/Bio-Circular Balanced Material, Energy Transition Material

LG Chem is well aware of the rapid changes going on in the world. In order to keep up the company’s growth at such a time, a new growth engine is required. For LG Chem, the engine refers to recycled materials, compostable/bio-circular balanced materials, and energy transition materials.

Until 2021, LG Chem made consistent contributions to the recycled materials market, in other words, PCR plastic market, by securing recycled raw materials and improving the physical properties of PCR plastics. Such commitment resulted in the company’s commercial production of world’s first PCR plastic material with a pure white color. And yet, LG Chem did not stop there, and is planning to expand their partnership with home appliances manufacturers along with developing PCR plastic materials with transparency. Furthermore, the company seeks to continue their R&D of PCR plastics with physical properties equivalent to the conventional plastics. In addition to PCR materials, LG Chem plans to promote commercialization of Circular-balanced materials in collaboration with UK-based Mura Technology and build a supercritical pyrolysis oil plant with an annual capacity of 20,000 tons by 2024.

In talk of new growth engines, you can’t take out compostable/bio-circular balanced materials. In August 2021, LG Chem already began exporting SAP (Super Absorbent Polymer) with waste cooking oil and plant-based bio raw material contents. Also under planning is the launch of commercial production plant of PBAT (Poly-Butylene Adipate Terephthalate), known for its fast decomposition, which is scheduled for 2024. Likewise, the company will expand the production scale of PLH (Poly Lactate Hydracrylate) to a commercial level, a material which offers extra transparency and 20 times the flexibility of existing compostable plastics.

The finale of LG Chem’s new growth engines is the energy transition materials, whose market is undergoing rapid expansion. Prompted by its growth, the market of PVEN POE (Photovoltaic Encapsulant Poly Olefin Elastomer) is also expected to rise. In 2021, LG Chem began installation to expand the production capacity of POE for solar panels by 100,000 tons, aiming to start mass-production in 2023. In addition, the company is developing a catalyst by which they will attain plastic using carbon dioxide as a raw material, hoping to reduce carbon footprints.

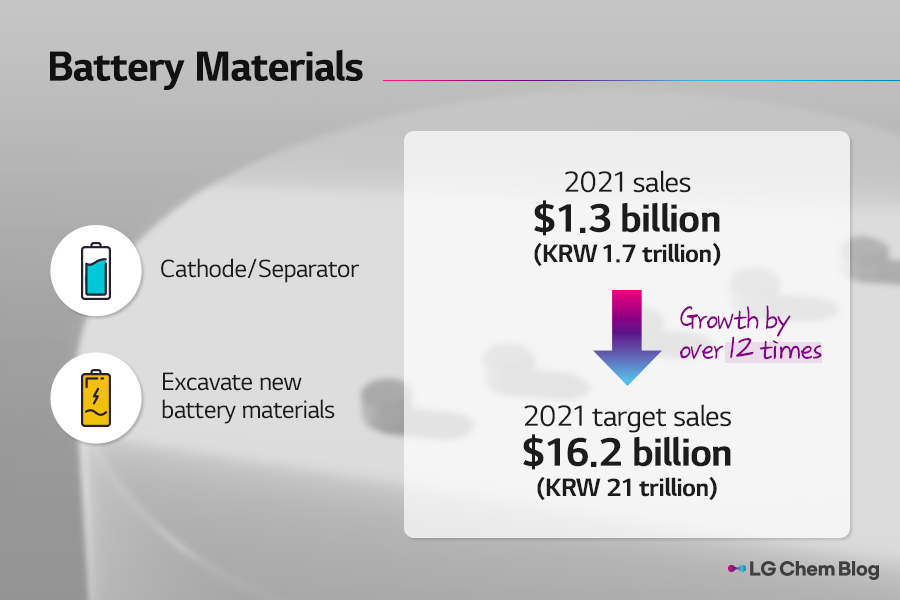

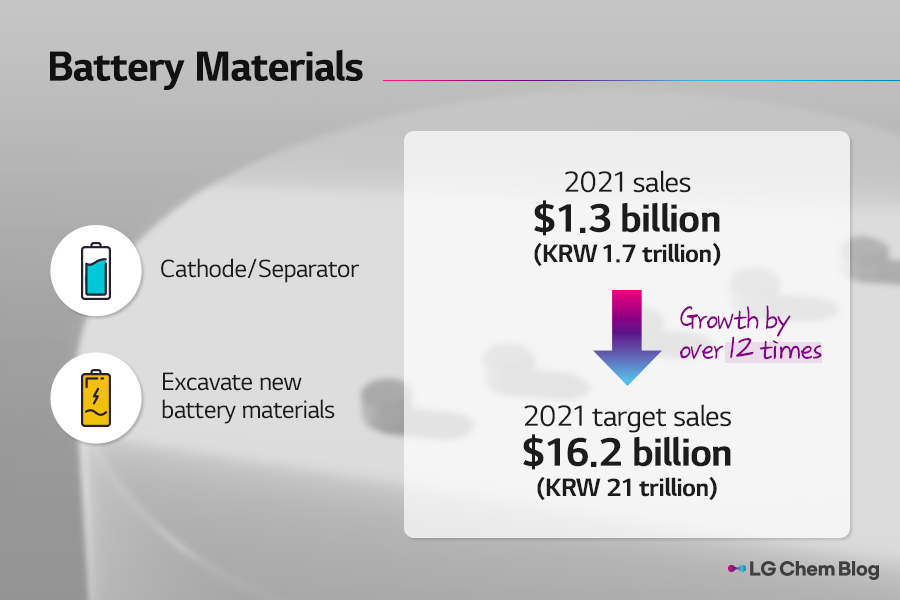

Battery Material – Cathode/Separator, Excavate New Battery Materials

In 2006, LG Chem became world’s first producer of NCM (Nickel, Cobalt, Manganese). Stretching out this long-time-accumulated technology, the company now plans to accelerate the growth of their cathode business. Ongoing discussions include collaboration with numerous companies to expand the proportion of high-nickel products to 90% of LG Chem’s overall battery production and secure the supply of metal. Besides that, LG Chem has also acquired share of Li-Cycle, America’s largest battery recycling company. Based on these efforts, the company plans to set up a global quadrilateral production system in Korea/China/Europe/USA and raise their production capacity to 260,000 tons by 2026.

In addition, LG Chem seeks to expand the separator business based on their proprietary technology including the safety-reinforced separator (SRS). In 2021, the company established a joint corporation with Toray, which holds a differentiated separator fabric technology, and acquired the coating business of LG Electronics, known for their quality coating technology. LG Chem will keep expanding their global production base and keep focus on the separator business.

Outside of that, LG Chem also intends to nurture battery supplementary materials such as CNT (Carbon Nanotube), thermal adhesive, anode binder, BAS (Battery Assembly Solution), etc. Furthermore, the company will accelerate the development of battery material technology that enhances battery performance and safety, along with next-generation battery technology including the materials for all-solid batteries.

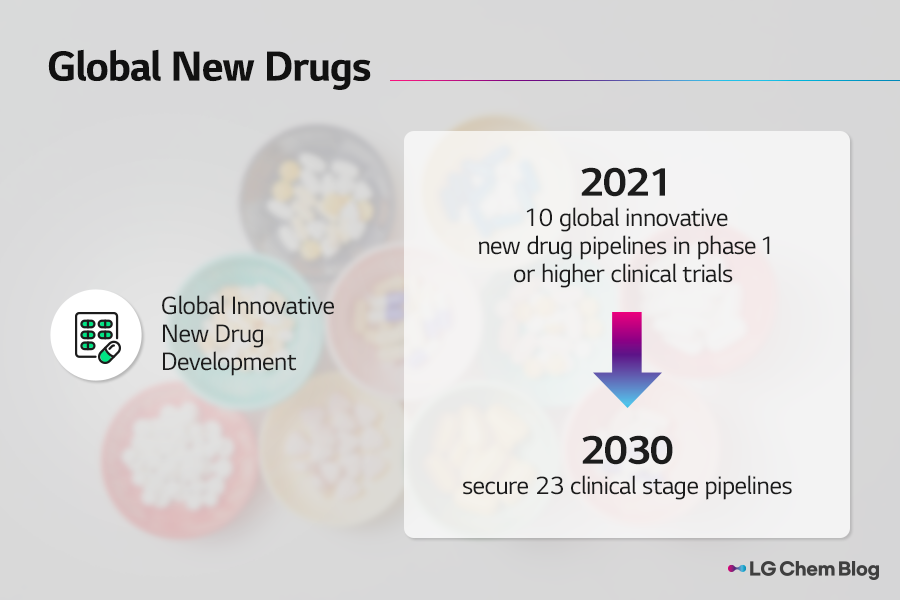

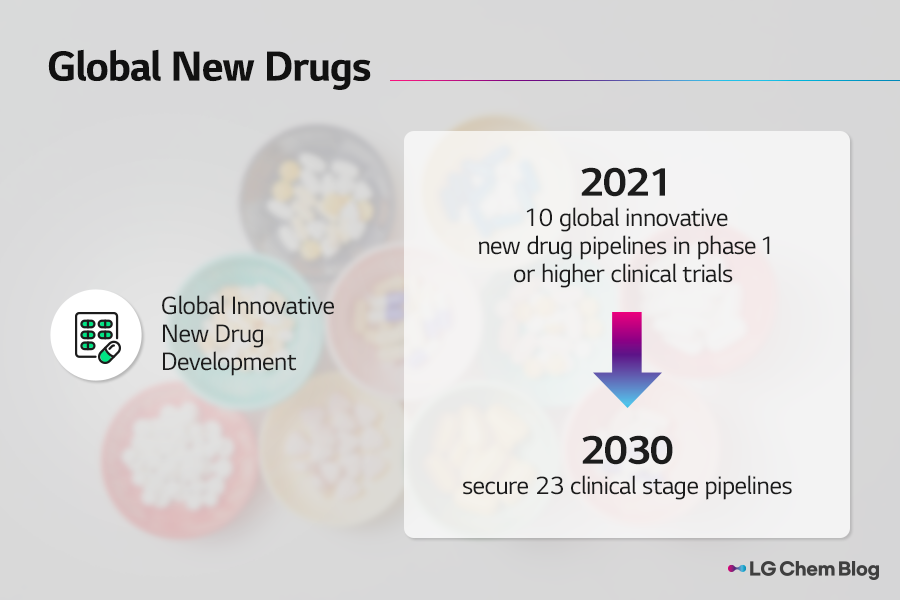

Global new drugs – Anti-cancer, Diabetes/Metabolism Global Innovative New Drug Development

Global new drug is another proportion of LG Chem’s major businesses. As of February 2022, LG Chem secured 10 global innovative new drug pipelines that have entered phase 1 or higher clinical trials. By 2030, the company plans to secure 23 clinical stage pipelines and commercialize at least two of them in major markets such as the US and Europe.

Move Up Carbon Neutral Growth Goal by 20 Years! Achieve Net-Zero in 2050!

LG Chem’s future goal is not limited to sales. The company understands their role as a science company to contribute to the global market and lead human life in a better direction. And thus, LG Chem is pushing forward the 2050 carbon-neutral growth target by 20 years and has set a goal of achieving Net-Zero by 2050.

To this end, LG Chem has established detailed action plans in three fields; Reduce, Avoid, Compensate. To begin with, the company intends to ‘reduce’ carbon emissions through introduction of innovative processes and conversion to eco-friendly fuels. Next, they will expand the use of renewable energy to ‘avoid’ carbon emissions. Finally, the company will take measures to ‘compensate’ unavoidable carbon emissions. Taking this further, by 2030, LG Chem plans to complete LCA (Life Cycle Assessment) for all domestic and foreign products, which quantitatively evaluates environmental impacts of a product from raw materials to manufacturing.

Since foundation in 1947, LG Chem has been striving to present a vision to human lives and values through repeated challenges and innovations. In 2022, which marks the 75th anniversary of their founding, LG Chem dreams of taking on new challenges and innovations to step up as a ‘Top Global Science Company.’ To achieve sustainable growth as a global science company and advance unwaveringly in any situations, LG Chem’s passion will continue on.

There are no comments yet! Be the first to let us know your thoughts!